Recycling Markets & Market drivers

Recycling materials as raw materials

Today, nearly 50 % of European copper demand is covered by metal recycling. And tomorrow? Head of Recycling Raw Materials Lars Radowitz provides an overview of the most important market drivers and explains why recycling is the future.

More metals for a modern world

While it used to be the G8 nations that discussed the challenges of the global economy, the G20 brings a much more varied group of players to the table. Continued industrialization is the primary goal of many emerging countries, which are encouraged by the promise of growth and prosperity. This goes hand in hand with increased migration to metropolitan areas, as well as a growing global middle class. These developments spur infrastructure expansions and demand for products using metals, particularly copper. “To make it more concrete: while the per capita consumption of copper is 6 kg in an industrialized country, it's not even 2 kg in a developing country,” states Radowitz. "There's a lot of catch-up potential."

“There's huge potential for recycling:

the global anthro-pogenic metal warehouse for copper amounts to about 400 million t.“Lars Radowitz

But the hunger for metals hasn’t been satisfied in industrialized nations, either. Trends like digitalization, electric vehicles, and smart homes drive demand. Copper plays a special role in all of this. It’s the metal of the energy transition. According to the German Copper Institute, renewable energy systems need up to twelve times more of the energy-efficient metal than traditional energy systems.

These trends will drive global metal demand and use. Annual growth rates of between 1.5 and 4 % are expected for copper, tin, nickel, and zinc. This growth comes from electronics, industry, and the automotive sector in particular and supports higher metal prices. Ultimately, a higher level of processed metal means that larger and larger volumes are available for recycling.

Global Recycling Potential

The anthropogenic metal warehouse is growing

These volumes boost the so-called anthropogenic metal warehouse, which consists of all of the metals that humans have removed from their natural deposits and used in our surroundings in the form of infrastructure, buildings, and everyday items. For copper, the German Federal Environment Agency assumes that the global anthropogenic warehouse reaches up to 400 million t and thus encompasses about 50 % of the current geological copper reserves. Or to provide another comparison: around two-thirds of the copper produced since 1900 is still in use today. Depending on how it’s used, it will be available for recycling again at some point. But one thing’s for sure: the volumes are growing.

Rising prices, more recycling possibilities

The attractiveness of recycling increases with the price, for both traders and smelters. Many metal prices are notably higher today than they were in the early 2000s. Copper, for example, was quoted below the US$ 2,000 mark back then. Today, a ton of the red gold is traded on the London Metal Exchange for nearly US$ 6,000. “Higher metal prices mean rising incentives to collect the materials and direct them to recycling," stresses Radowitz.

With higher metal prices expected over the long term, the supply of recycling materials should grow.

Our world is becoming increasingly complex

The life cycles of today’s products are becoming shorter and shorter. This is especially apparent in consumer electronics – how many TVs are older than ten years anymore? According to a study by the German Öko-Institut, however, more than half of all TVs that are replaced still work. The reasons are attributed to things like too few functions, energy consumption, or simply not liking the current model. Each product generation has a different composition of materials as newer, more efficient production processes and alloys come into use.

Society is becoming ever more digitalized, prompting industry to release a number of innovative products. For instance, the more widespread use of electronic steering systems in vehicles will lead to a higher accumulation of precious metals, tin, and nickel in vehicle recycling. “Our consumer society is producing more and more recycling materials, which are becoming increasingly complex at the same time. Specifically, they contain a growing variety of elements and compounds,” states Radowitz. “This presents Aurubis with both challenges and opportunities.”

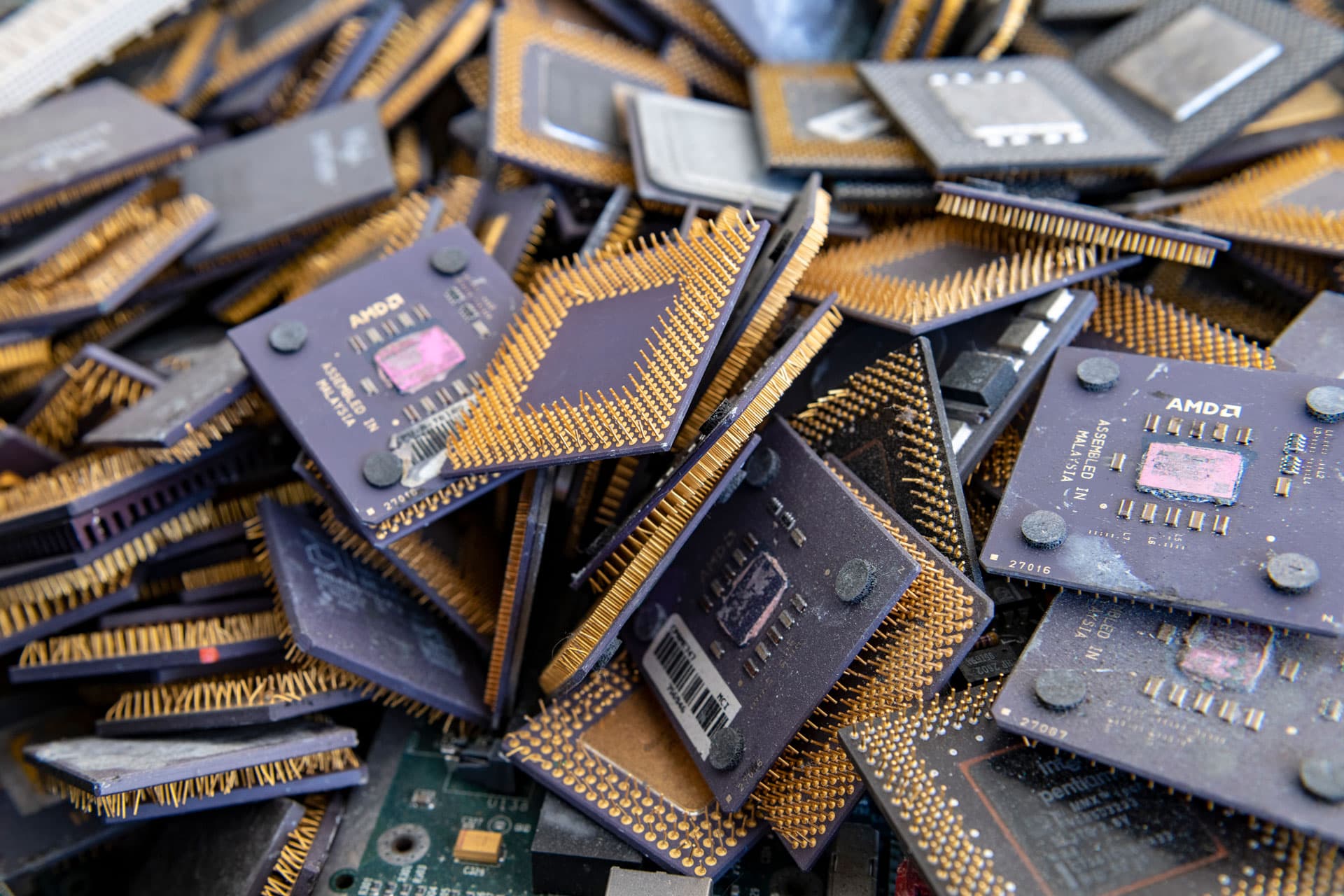

Aurubis processes electrical and electronic devices. High-performance processors, connectors, and electronic resistors in particular include a high proportion of gold.

Local preprocessing

End-of-life products and residues from Western industrialized countries will have to be processed locally to a greater extent in the future. Many developing countries where end-of-life products have been manually disassembled up to now are reducing their imports. Apart from that, processing in these countries rarely fulfills the high standards of the EU. Consequently, recycling capacities in Europe have to be expanded and exports of end-of-life products have to be reduced. “Former export regions like Europe and North America need more of their own efficient, sustainable recycling solutions down the road. The political framework in this context is also extremely important,” asserts Radowitz. “We at Aurubis want to be part of the solution.

"Former export regions like Europe and North America need more of their own efficient, sustainable recycling solutions."Lars Radowitz

Responsibility moves into focus

Environmental protection is one of our society’s central issues for the future. This is evident not just in people’s increasing awareness but also in stricter legislation such as the WEEE directive, a standard for copper and precious metal processing that also regulates electrical and electronic waste. The directive positively impacts collection systems as well, which leads to rising volumes of electronic scrap. Nevertheless, the collection rate of around 45 % for this type of scrap indicates that there’s still a great deal of potential.

The consumer goods industry and original equipment manufacturers (OEMs) are also showing heightened interest in recycling. They’re all placing a stronger emphasis on closing the loop. Moreover, they’re pushing for transparent and efficient waste management systems. After all, the social and political pressure impacts every economic actor and calls for sustainable joint solutions that will positively influence the entire recycling market in the long term.

For Aurubis, growing quantities of increasingly complex recycling materials open up a great deal of potential for growth in recycling. “With our technical processing expertise, first-class environmental standards, and strong metal recovery rates, the market conditions in recycling reveal attractive opportunities for long-term business success,” says Radowitz.

THE COPPER VALUE CHAIN

Copper recycling includes material from end-of-life products such as cable, wire, and electronic devices, as well as from melting down production waste.